What are financial instruments?

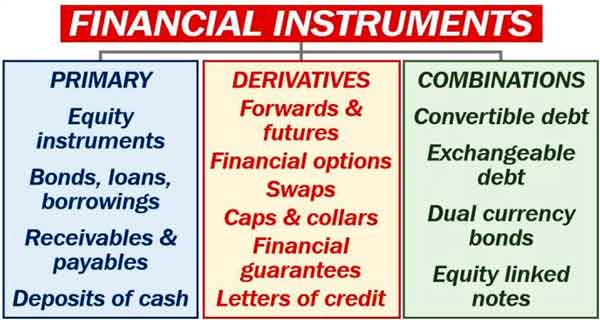

A financial instrument is a contract between two parties to sell assets. This document creates an asset for the buyer and a liability for the selling party. The assets on which these contracts are based are usually equities, bonds, currencies or commodities.

Financial derivatives

Financial derivatives are financial instruments where their price is derived from the price of another financial asset.

They are a contractual arrangement where the price of the derivative is taken from the underlying asset from which they are derived, such as stocks, indices, currencies, commodities, bonds, among others.

Characteristics of derivatives to be taken into account:

Leverage. This is their main characteristic. To trade them you do not need to invest a large amount of money. It is an advantage, if it goes the way you want, but if not, a big risk.

They allow us to speculate on the right to buy or not to buy an asset and future price of an underlying asset.

There are financial derivatives that replicate other financial assets, such as stocks, but there are others that are subject to the evolution of non-financial assets, such as commodities (wheat, oil, soybeans, among others) or metals (gold, silver, among others).

Many derivatives are traded on organised exchanges, but there are others that are traded on OTC or over-the-counter markets.

Types of financial derivatives

There are several, and within financial derivatives, a distinction can be made between those listed on organised markets and those listed on OTC markets.

In organised markets

They are regulated by the financial authorities, and there are institutions that control them to ensure their correct functioning. Among them are:

Financial options

Futures

Its main markets are:

- US COMEX

- US NYMEX

- UK LIFE

- Meff of Spain

- TFX of Japan

- BM&FBovespa of Brazil

These are the recommended ones, everyone takes their own risks. We prefer those listed on organised markets.

On OTC markets

OTC markets, which stands for Over the counter, are not regulated by the financial authorities. Trades are agreed between buyer and seller, so there is a lot of risk.

They include:

Cfds

Binary options

Warrants

We will see one by one in the following topics, so that you can learn about these types of derivatives, but remember that OTC markets are riskier and not recommended for beginners.

Advantages of financial derivatives

- Low investment amount compared to other investments.

- High leverage.

- Possibility to hedge other operations.

- Possibility of gaining from (downward) declines.

Disadvantages of financial derivatives

- Speculative.

- Leverage, if misused, creates excessive risk and can cause you to lose all your money.

Summary:

In short, you can make money in the markets with any of the above financial products.

Some people focus on just one, others diversify with two or more, and so on. Depending on the type of trading you are interested in, different types of instruments will be adjusted. You should also take into consideration the capital you have available. Therefore, we have made a table with the main characteristics of the financial instruments that we have been explaining in this module, so you can decide which one suits you best.